Vendor Setup

Before entering vendors into New World ERP, you must first set up several different types of information that will default for users when adding new vendors. Click one of the links below for instructions on performing the following procedures:

Secured fields are also an option on the vendor record and need to be set up if your organization plans to use them. SeeVendor Secured Fieldsfor more information.

Setting Up Vendor Validation Sets

Maintenance > new world ERP Suite > System > Validation Sets > Validation Set List

- 25—Vendor Category

- 26—Vendor Type

- 28—Freight Terms

- 29—Hold Payment Reason

- 47—W9 Form

- 81—Grantee Type

- 258—AP Payment Sort Group Code

Defining Vendor/Item Defaults

Maintenance > new world ERP Suite > System > Company Suite Settings > Vendor/Items tab

- General

- Vendor/Audit

- W-9 Processing

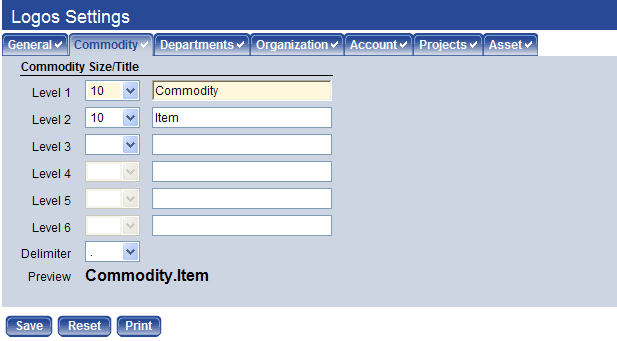

Defining Commodity Levels

Maintenance > new world ERP Suite > System > New World ERP Settings > Commodity tab

The system allows up to 6 levels. You define the number of characters for each level and its corresponding title. You could use the NIGP standard commodity codes as a reference when setting up the codes in New World ERP. Only the number of levels to use can be define.

Setting Up User-Defined Fields

Maintenance > new world ERP Suite > Security > User-Defined Fields

User-defined fields allows the creation of custom fields to capture specific information for vendors.

Creating Invoice Terms

Maintenance > new world ERP Suite > Miscellaneous Definitions > Invoice Terms

Use the Invoice Terms page to define when vendors expect payment (e.g., 30 days or on the 1st day of the next month). Invoice terms may also include discount periods and discount terms (e.g., 2% 10, Net 30). The discount period and terms specify that when payment is made in full within the agreed upon number of days from the receipt of the invoice, a percentage discount can be taken.

Creating Sales Taxes

Maintenance > new world ERP Suite > Miscellaneous Definitions > Sales Taxes

Note: NOTE: You only need to create sales tax if your organization pays sales tax, otherwise disregard this section.

Sales Tax Codes provides the ability to track the sales tax that must be paid on goods purchased. If vendors do not add sales tax to their invoice, the municipality may still be responsible for paying the appropriate tax to the collecting entity (local or city, county, or state). Sales tax codes are used in AP invoice processing to calculate sales or use tax associated with the invoice. See Sales Tax for more information.

Setting Up Commodities

Maintenance > new world ERP Suite > Procurement > Commodities

As part of vendor setup, you must also set up the commodities that can be associated with vendors.

See Also

Add a New Vendor Type or Category